Escape Manual Data Entry Hell - Tax Preparation Solution for CPA's

During tax season, CPAs and EAs in the US face a mountain of manual data entry tasks. This not only eats up tax preparation time but also leads to errors. In the United States, only 90% of taxes are processed every year, according to this IRS report.

They say it’s because taxpayers who request an extension for income tax filing date every year generally have more complex finances. Fortunately, with the rise of AI and advanced tax automation solutions, there's a chance to simplify tax preparation and pave the way for a new era of streamlined tax preparation processes.

Let's address the elephant in the room:

AI and machines will not take away jobs. But, 'smart' machines will reduce the need for human labor. To give you a better picture of this, in this blog, we'll delve into how AI-powered tax automation solutions are revolutionizing the way CPAs and EAs approach tax filing.

Not just that, we’ll also dig deep into its benefits, what are the best tax softwares for tax preparers in the US, and how these solutions make manual data entry a thing of the past.

The Transformative Impact of AI in Taxation & Accounting

The integration of AI in accounting has unleashed a transformative wave, particularly in tax preparation. The tedious tasks of manual data entry, interpretation, and analysis no longer shackle CPAs and EAs. AI isn't just about algorithms and codes; it's a game-changer liberating accountants from the daily grind of data entry, invoice processing, and reconciliation. This not only expedites the tax preparation process but also enhances the accuracy of calculations and ensures compliance with ever-changing tax regulations.

Think of it this way: You'll have AI systems swiftly and accurately handling routine tasks, freeing up your valuable time to focus on strategic endeavors.

AI has sophisticated algorithms that help them scan through extensive datasets, revealing patterns and uncovering anomalies invisible to the human eye in accounting. The result? Financial reporting that oozes precision is backed by real-time insights, taking decision-making to a new level.

But It doesn't stop at number-crunching. It steps into prediction. Dissecting historical data becomes your financial crystal ball, enabling precise forecasting. This isn't clairvoyance; it is the evolution of strategic planning, giving your organization the edge to stay a step ahead.

Data Avengers: Rescuing CPAs From the Time-Draining Abyss of Manual Extraction

Advantages of Tax Automation for CPAs and EAs

1. Quick Data Extraction and Discovery

AI-powered tax preparation solutions excel in rapid data extraction and discovery, significantly reducing the time spent on gathering and organizing financial information. CPAs and EAs can leverage these tools to extract pertinent data from diverse sources, ranging from bank statements to payroll records, with unprecedented speed and efficiency.

2. Time Efficiency and Reduced Manual Errors

By automating manual data entry tasks, AI tax software for CPA firms frees up valuable time to focus on higher-value activities such as strategic tax planning and client advisory services for CPAs and EAs. Moreover, the risk of manual errors inherent in traditional data entry methods is mitigated, ensuring greater accuracy and reliability in tax filings.

3. Increased Accuracy in Calculations and Compliance

AI tax software boasts advanced algorithms capable of performing complex tax calculations with unparalleled accuracy. Additionally, these solutions stay abreast of evolving tax laws and regulations, thereby ensuring compliance and minimizing the risk of costly errors or audits.

4. Enhanced Collaboration and Data Security

Modern AI tax software platforms facilitate seamless collaboration among team members, allowing CPAs and EAs to work together on tax filings in real-time, irrespective of geographical location. Furthermore, robust data encryption protocols and multi-factor authentication mechanisms ensure the utmost security and confidentiality of sensitive financial information.

Key Dates in Income Tax Filing and Navigating the Income Tax Filing Deadline 2024

As tax professionals embark on their journey to escape manual data entry hell, staying informed about key dates and deadlines in income tax filing for 2024 is crucial. Individual income tax returns are typically due on April 15 unless the date falls on a weekend or holiday, in which case the deadline may be extended to the following business day.

Additionally, taxpayers may file for an extension using Form 4868, which grants them until October 15 to submit their tax returns.

Escaping Manual Data Entry Hell: A Step-by-Step Guide

To facilitate a smooth transition from manual data entry to automated tax preparation processes, CPAs and EAs can follow these steps:

- Evaluate Current Workflow:

Assess existing workflows and identify areas prone to manual data entry errors or inefficiencies.

- Research AI Tax Software:

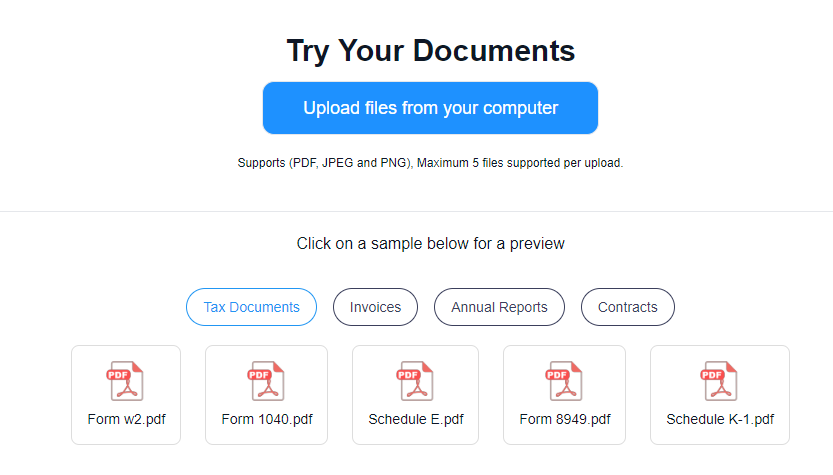

Explore various AI tax software solutions available in the market, considering factors such as features, pricing, and user reviews

Qsense is best suited for automated tax statement analysis and anomaly detection. Qsense offers streamlined data extraction and analysis, auto-classification of extracted data, and conversational querying with NLQ. This AI tax software for CPAs and tax professionals helps enhance their preparation workflows with robust technology.

- Select the Right Tool:

Choose a tax automation platform that aligns with the specific needs and budget constraints of your practice.

- Implement Training Programs:

Provide comprehensive training to staff members on the use of AI tax software, ensuring seamless adoption and utilization.

- Monitor Performance:

Continuously monitor the performance of the chosen tax software, soliciting feedback from team members and clients to identify areas for improvement.

- Stay Updated:

Stay abreast of industry developments and regulatory changes, leveraging AI tax software's capabilities to adapt to evolving tax landscapes effectively.

Securing CPA Tax Preparation with Automation

AI-powered tax automation solutions offer CPAs and EAs a viable pathway to escape the manual data entry hell that often plagues traditional tax preparation processes. By leveraging advanced AI technology, tax preparers can streamline tax return preparation, enhance accuracy, and improve client satisfaction.

However, success hinges on selecting the right tax software, implementing robust training programs, and staying up-to-date with important deadlines in income tax filing dates.

As the deadline for income tax filing approaches in 2024, CPAs and EAs embracing the transformative potential of AI in accounting will help navigate the complexities of tax preparation with confidence and efficiency.

Final thoughts

In the midst of tax season, CPAs and EAs can save themselves from manual data entry when they automate tax filing. Embracing AI advancements will unlock strategic potential. But the journey isn't without challenges; choosing the right software and implementing thorough training are essential.

As we stand on the brink of a new era in tax preparation, there are multiple softwares for streamlining tax return preparation. We’ve covered the top five of them in our blog to help ease accounting difficulties in 2024. Now, it’s up to you what smart choice you make this tax season.

You have reached the maximum per-minute rate limit.

Try again in one minute.